Germany’s pension system (Rente) continues to evolve in 2025 to address the challenges of an aging population, inflation, and financial sustainability. Recent updates and reforms aim to balance the needs of current retirees while ensuring long-term stability for future generations.

Pension Increases for 2025

The German government announced a significant pension increase for 2025 to help retirees cope with rising living costs. From July 1, 2025, pensions in western Germany will rise by 4.1%, while those in eastern Germany will see a 4.5% increase. This adjustment reflects the country’s ongoing efforts to harmonize pension levels across the nation and protect retirees’ purchasing power amidst inflation.

The increase is based on wage developments and aligns with the statutory mechanism to adjust pensions annually.

Retirement Age Discussions

Debates around the retirement age remain a contentious topic in 2025. The statutory retirement age is currently being gradually raised to 67 years by 2031, but some policymakers and experts are calling for further increases due to demographic shifts.

Germany’s aging population means a shrinking workforce is supporting a growing number of retirees. Critics of raising the retirement age argue that not all professions are suitable for extended working lives, especially in physically demanding sectors. Proponents, however, highlight the financial pressures on the pension system, advocating for reforms to ensure its long-term viability.

Flexible Retirement Options

The trend toward flexible retirement options continues in 2025, with more Germans opting for partial retirement (Teilrente) or combining work with receiving a pension. Programs like “Flexirente,” introduced in 2017, have become increasingly popular, allowing individuals to gradually transition into retirement.

This approach not only benefits retirees who wish to stay active but also helps alleviate labor shortages in certain industries.

Pension Reform Proposals

The federal government is exploring several proposals to modernize the pension system:

- Introducing a Share-Based Pension Fund: A “Generationenkapital” (generational capital) initiative is under discussion, where a portion of pension contributions would be invested in the stock market to generate higher returns.

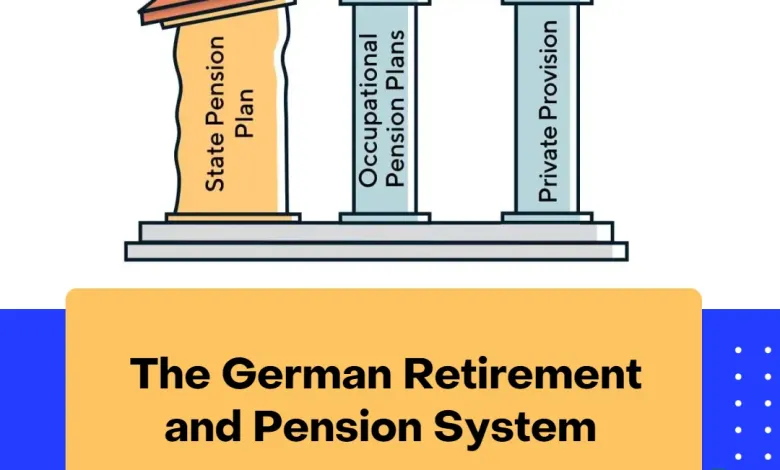

- Encouraging Private Retirement Savings: The government aims to incentivize private and occupational pension schemes through tax benefits and employer contributions.

- Stronger Support for Low-Income Pensioners: Plans are underway to expand the Grundrente (basic pension) for retirees with limited financial resources, ensuring a more equitable system.

Public Opinion and Challenges

While the pension increase has been welcomed by many, concerns persist about the system’s sustainability. Young workers express skepticism about whether they will receive adequate pensions in the future, while retirees worry about inflation eroding their purchasing power.

Balancing fairness, financial sustainability, and social security remains a complex challenge for policymakers in 2025.

Conclusion

Germany’s pension system is undergoing significant changes to adapt to evolving economic and demographic realities. With pension increases, flexible retirement options, and ongoing reform discussions, the government is striving to meet the needs of current retirees while safeguarding the system for future generations. As debates continue, the decisions made in 2025 will shape the future of pensions in Germany for decades to come.